Being a single mom is a challenging and rewarding experience, but it can also be financially stressful. Managing finances on your own can be tough, but with a little effort and planning, you can take control of your money and create a secure financial future for you and your family. Here are 15 tips to help single moms manage their finances effectively.

- Create a budget: Start by making a budget that includes all your income and expenses. This will help you keep track of your spending and plan for the future. Budgeting can be daunting but it’s important that you learn how to budget well. List your expenses and when they are due. Then list how much you make every month. Make sure you budget for all of the extras you might have during the month that can add up. This will help you feel a sense of control over where your money is every month.

2. Cut expenses: Look for ways to reduce your expenses. For example, cook at home instead of eating out, shop for groceries at discount stores and cancel subscriptions that you don’t use. There are many little ways that you can cut monthly expenses. Think about a few cheaper food options or discount clothing stores. Cutting expenses can be hard but can help get you on a good path to financial freedom.

3. Build an emergency fund: It’s important to have a cushion of savings to fall back on in case of unexpected expenses, such as car repairs or medical bills. Building an emergency fund is very important just in case the worse happens and you need to dip into something that you weren’t expecting. Setting up a savings account can help with unexpected costs that can creep up.

4. Prioritize debt repayment: Pay off high-interest debt first, such as credit card debt. Make minimum payments on other debts while you focus on paying down the high-interest debt. You can also find zero percent cards to roll the high-interest payments onto. Focus on paying down debt it will help you feel the burden lighten as you dig out from under it.

5. Seek financial assistance: Don’t be afraid to seek help if you need it. There are government programs, charities, and community organizations that can provide financial assistance to single moms. Food stamps, rental assistance, and other programs are available when you are really low. It’s a very helpful tool to use when you are scraping the bottom of the barrel.

6. Use coupons and deals: Take advantage of coupons and deals to save money on purchases. Look for online deals and printable coupons that you can use at local stores. There are great apps that you can use to help save money. Ibotta and Fetch are two great coupon apps that get you money on all the groceries that you buy.

7. Plan for retirement: It’s never too early to start planning for retirement. Consider opening an IRA or other retirement account and contributing regularly. Planning for retirement can be scary but it’s important that you sow into your future. The care that you will need when you are older shouldn’t be shouldered only by your children. Help set your future up by learning about IRAs.

8. Invest in education: Education is one of the best investments you can make in your future. Consider going back to school to improve your earning potential. The greatest investment that you can make is in yourself. If you find something that you are passionate about pursue that and learn all you can about it. Be the best in the field that you choose. This will guarantee your earning potential goes up.

9. Shop for insurance: Shop around for insurance to make sure you’re getting the best rates. Consider bundling policies for additional savings. Insurance is a necessary evil we all have to have so make sure that you choose one that best fits your needs. If you think that you are paying too high a rate make sure you shop around and do some comparisons.

10. Avoid unnecessary expenses: Try to avoid impulse purchases and unnecessary expenses. Before making a purchase, ask yourself if you really need it. It can be hard sometimes to avoid purchasing bigger and better things but it’s important to have some self-control when possible and save for the future. Remember what your goals financially are some that can help you stay focused.

11. Consider a side hustle: A side hustle can provide extra income to help make ends meet. Consider freelancing, pet-sitting, or driving for a ride-sharing service. There are some great side hustles that provide great income and flexibility for single parents. There are companies like Shipt, Doordash, Uber, and Instacart that help to provide you with free lance opportunities that are great for parents.

12. Create a will: It’s important to have the will to ensure that your assets are distributed according to your wishes in case something happens to you. Wills can be a hard thing to face. The reality that one day we might not be on this earth can be scary but it’s important to face that reality and put paperwork in place so that your child or children will be protected.

13. Set financial goals: Set short-term and long-term financial goals and work towards achieving them. This will help you stay motivated and focused. Goals are so important to help keep focused on what the motivation is when it gets hard to be constrained by a budget or put money in savings. Write out your goals and focus on what it means to achieve them.

14. Seek financial advice: Consider consulting a financial advisor to help you plan for the future and make informed decisions. It’s always a good idea to talk with an advisor. They can bring a perspective that you might not have thought about and give you advice you had never heard before.

15. Teach your kids about money: Finally, it’s important to teach your kids about money and financial responsibility. Start early by teaching them about saving, budgeting, and the importance of giving back to others. Pouring into your children and teaching them about financial responsibilities is a vital role for their future success.

Managing finances as a single mom can be challenging, but by following these tips, you can take control of your money and create a secure financial future for you and your family. Remember to stay motivated, set goals, and seek help when you need it.

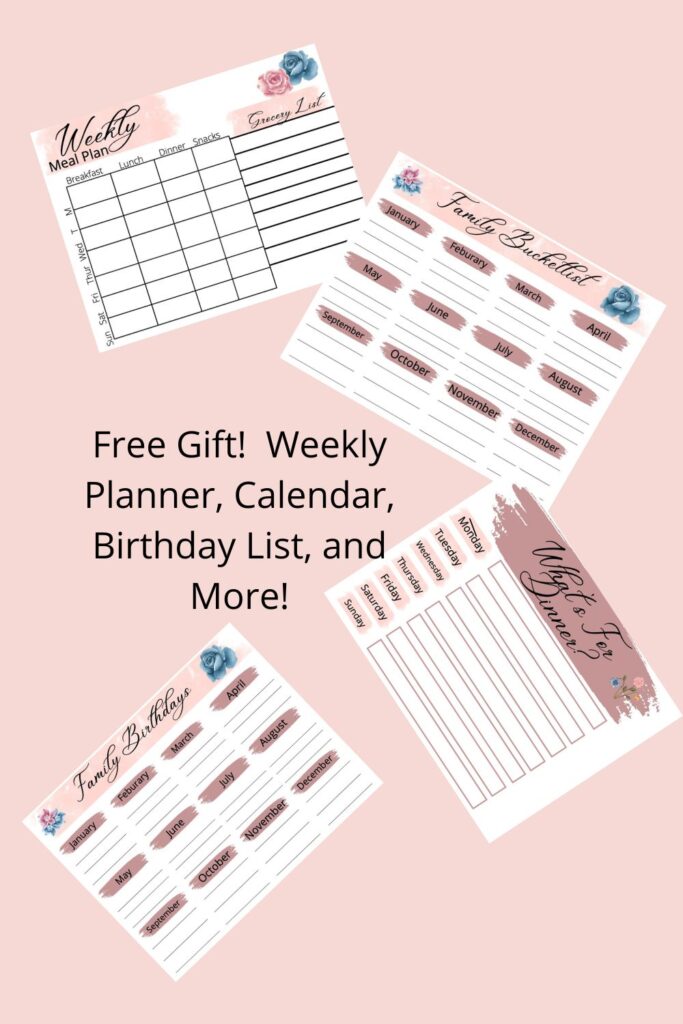

Sign Up For Free!